Introduction to Real Estate Wholesaling Investing

Real estate wholesaling investing offers newcomers a low-cost entry into property investment. The approach centers on negotiating discounted contracts and transferring them to end buyers for a fee. Wholesalers minimize upfront capital requirements and eliminate long-term management expenses by flipping contracts. Wholesaling builds competence in identifying opportunities, negotiating terms, and executing agreements. Quick contract flips generate faster returns than long-term rental investments. Maintaining a vetted list of investors prepared to purchase contracts is essential for smooth assignments. Consistency and integrity in negotiations foster long-term relationships and business momentum.

Why Choose Real Estate Wholesaling Investing

This low entry cost allows beginners to begin investing without large financial commitments. Profit potential emerges rapidly due to shorter deal cycles compared to long-term rentals. Wholesaling teaches negotiation, deal evaluation, and network building useful across the property sector. By avoiding property ownership, wholesalers evade landlord responsibilities such as maintenance and tenant management. Building a robust contact list of real estate professionals supports deal flow and referrals.

Successful wholesale deals can fund subsequent investments, leveraging small gains into larger ventures. Consistent assignment fees help streamline your financial projections and expense management. This model helps preserve working capital, preventing the cash shortages that rental properties sometimes incur. One-time gains from wholesaling usually involve simpler reporting compared to regular rental revenue. Access to mentorship and mastermind groups accelerates learning and opens doors to off-market deals. Digital marketing and CRM tools can further enhance lead generation and follow-up efficiency. Tapping into specialist blogs and courses refines your strategies and market knowledge.

To learn more about investing in real estate wholesaling, visit: how to real estate wholesale

Key Resources to Fuel Your Wholesaling Business

An integrated CRM organizes contacts, tracks communications, and prompts timely outreach to each prospect. Digital lead solutions aggregate data on absentee owners and pre-foreclosures, giving you a head start on potential deals. Automated profit models compute key metrics like cap rate and cash-on-cash return to validate deals fast. Online signature services streamline legal paperwork, enabling remote closings without printing or scanning. Email and SMS sequences tailored to seller profiles drive engagement and increase response rates. Title company portals provide real-time updates on closing requirements and fund transfers, helping you track each assignment to completion. Specialist wholesaling groups and marketplaces allow you to showcase contracts directly to a vetted buyer list.

Consistently leveraging these tools transforms complex workflows into streamlined processes, letting you focus on negotiation and scaling your business.

How to Launch Your Wholesaling Venture

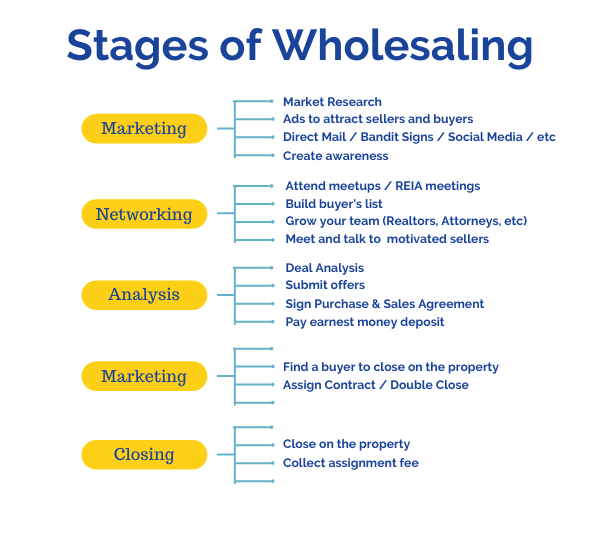

Begin by educating yourself on local market dynamics—study recent sales, price trends, and neighborhood developments. Compile a list of motivated seller leads through direct mail, bandit signs, and online advertising campaigns. Prepare a standard purchase agreement that includes clear assignment rights, vetted by legal counsel. Role-play seller conversations to build confidence and handle objections effectively. Collect contact information from lenders, rehabbers, and rental investors to form your buyer pool. Automate lead responses and drip campaigns so that no prospect goes unattended. Submit your inaugural purchase proposal, monitor conversion rates, and refine your strategy with each assignment.

Common Pitfalls and How to Avoid Them

Overestimating property values or ARV can lead to unprofitable deals—always verify numbers with multiple comps. Neglecting to factor in rehab expenses risks negative returns—always secure precise contractor bids beforehand. Failing to build a robust buyer’s list can leave contracts stranded—continually grow and update your investor network. Poor follow-up habits result in lost leads—implement automated reminders to maintain consistent communication. Overlooking legal nuances in assignments can cause disputes—have your agreements professionally reviewed. Taking on excessive contracts without proper systems in place increases errors—grow your pipeline in manageable stages. Disregarding market signals results in missed opportunities—regularly update your approach based on current data.

Wrapping Up Your Wholesaling Investment Journey

Real estate wholesaling offers a practical, low-risk avenue for new investors to generate income and build expertise. Honing expertise in identifying opportunities, calculating profits, and closing assignments sets you apart in the market. Adopting technology for lead management, profit calculations, and follow-up streamlines your operations. Ongoing learning, transparent dealings, and strong relationships drive repeat business and sustainable growth. Launch your first contracts, learn from each outcome, and deploy assignment fees to grow your wholesale enterprise. Through consistency and smart implementation, wholesaling contracts will anchor your broader property investment strategy.

Embrace the journey, leverage the resources at real estate wholesaling explained, and watch your wholesaling success unfold.